They pay late, or too little. They’re not sure what they want. They’re unavailable when you have questions, and sometimes downright abusive when they do pick up the phone. They’re clients from hell, and as a freelancer, you just don’t need this grief.

And yet, tales of client woes are an epidemic in the freelance world. Stories of the best friend you went to work for, who underpaid you for years. Or the company that never raised your rates, even as your responsibilities grew. The one that disappeared with your big final payment.

Wouldn’t it be nice if you could avoid freelance writing clients from hell like these?

Well, for the most part, you can! There are some classic warning signs that things will go wrong — if you know what to look for.

Here’s my guide to quickly screening out losers:

Find out who they are

It amazes me how many freelance writers take gigs without having any idea of the size, age, or income of a business. They get a message signed, “Joe” — no website listed, no phone number — and the next thing you know, they’re writing for them. And the next thing you know, the writer’s been stiffed.

“Can you believe that?” they ask me. Y E S. Yes, I can. It really pays to spend 10 minutes checking them out online.

Golden rule: If a client can’t give you a website to look at, run.

Beyond their site, easy ways to learn more include checking LinkedIn for a company page — and seeing how many employees they say they have. Under 10 is a red flag. Over 100 makes me more comfortable that they have a clue (and probably a decent marketing budget).

That LinkedIn page is also good for finding out whether the company has been in business longer than a few months. In general, startups make poor clients for freelancers, as they don’t yet have steady income and tend to be chaotic and disorganized.

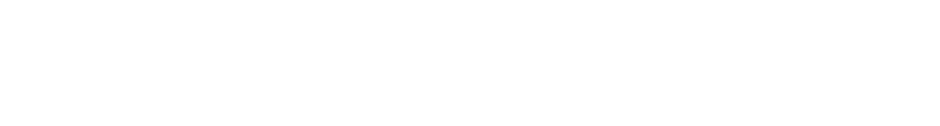

Revenue numbers can take more advanced research skills to track down, but at least check their website for press releases about sales growth, new clients, acquisitions, and such. Or Google “revenue at <company name>”.

If it’s a big enough company, Google could shoot you an instant answer, like this:

As you can see, they also throw in competitor info as a bonus — sweet.

For smaller companies, you might try Hoovers. If they’re tech-ish, see if they’re listed on CrunchBase. This site can be a goldmine of information on founders’ past business successes (or failures), and tell you how much investor money they’ve raised.

If you can’t get any intel through these methods, the company is likely too small or dysfunctional to be a good client. Move along! Nothing to see here…

Verify their claims

If a prospect gives you some background on their business, try to verify their statements and make sure they’re real. Don’t just take their word for it. Sadly, I’ve had people impersonate me and hire writers, and then stiff them. There are a million scams online! Don’t be a victim.

A few of the writers who saw ‘Carol Tice’ hiring on Elance took the time to compare the listing’s contact email with the one on my websites. They noticed the two weren’t the same. They reached out to me direct, learned they were the victim of fraud, and didn’t get ripped off. Many others weren’t so lucky.

Fraudsters will tell you they’re from Costco (seen recent reports on that one) or some other major corporation. Follow their links closely to see if it’s really that big company. I like to see my contact’s name on their site, or confirm other company facts they’ve given me.

Scan for gossip

Don’t be in the dark about your prospect’s reputation. Others have worked for these folks before. Did they think this was a nice, ethical company, or a total nightmare? Make it your business to know.

Two quick ways to check for trouble:

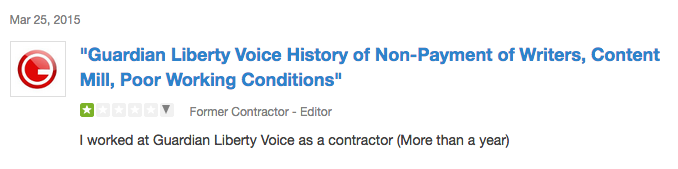

1: Look up reviews on Glassdoor (for instance, check out these reviews of notorious ‘news’ website Guardian Liberty Voice). You may see things like this:

2: Google “<company name> sucks” and see what you get. The latter can be brilliant for turning up blog posts where writers vent about their bad freelance experiences. You can also try the Blog Search Engine to turn up negative company chatter.

Of course, you should ask your writer community as well. Sometimes, you’ll learn that dozens of other writers got the exact same email! And mass-mailing is another sign it’s not a good client.

Be skeptical

In all, take a ‘buyer beware’ attitude toward email nibbles and reach-outs you get on social media. Assume that queries you get with absolutely no concrete details about the company or the project have a high likelihood of being from potential clients from hell — because good clients aren’t mysterious that way.

Some bad-client buzzwords I watch out for:

“Let’s collaborate” or “Interested to partner with you” — These are never lucrative offers. More usually, it’s someone who wants to buy a link in a popular post without disclosing it’s paid. And that’s unethical. The other angle here is they may want you to work in exchange for equity shares in their company — an angle that almost never results in a paycheck.

“We’re hiring hundreds of writers” — Bad news: There is no business model that pays writers well, where hundreds of writers are employed. I’ve been researching this angle for a decade, and have never seen a single instance where this works out well for the writer. It’s a guarantee pay is teeny, or that the business has no idea how to make a profit.

Remember, if it sounds too good to be true, it probably is.

Always get a contract and deposit

Starting work with a new client? Here’s the easiest, fastest way to screen out clients from hell — ask for a deposit.

I like 50%, but I know writers who ask for 100% of the first small piece up-front. In any case, don’t ask for less than 30% up front.

When you require a deposit, something magical happens: 90% of the flaky, loser clients disappear. They won’t pay the deposit. They balk. They have excuses.

Why? Because their plan is to rip you off. Or they never use freelancers and don’t understand how that works — another warning sign of possible clients from hell.

Once you ask for a deposit, follow through and don’t start working until you receive and cash that check.

Sometimes, these checks bounce — in fact, there are common work-from-home scams that send you a bad check as the first step in their process. You turn in some work before realizing the check is rubber, and then the company vanishes.

To repeat: Don’t work without that deposit and signed contract in your hand! I know a writer who’s out $2,000 right now, because she started working on the promise of a deposit…but it never arrived.

You can stop attracting clients from hell

If you get a lot of the scammy, suspicious reachouts from prospects I’ve detailed above, it’s time to take a look at how you’re marketing.

Are you clear on your expertise? Industries you specialize in? Do you have an online portfolio up? A strong LinkedIn profile? The more you do with your inbound marketing online to show you’re a savvy professional, the less scam artists will target you.

Quickly screening out time-wasting loser prospects will leave you more time to perfect your process to get better clients. The end result: You end up earning way more.

Who was your worst client? Leave a comment and give us your client from hell avoidance tips.